Investment Intern (Harvard Kennedy School's MPA/ID Programme)

Climate Fund Managers

Are you ready for your next play? We are bold, respectful, and we deliver, with Impact. Our long-term vision is to raise, deploy and manage funds for climate change mitigation and adaptation that will play a transformative role in our target sectors.

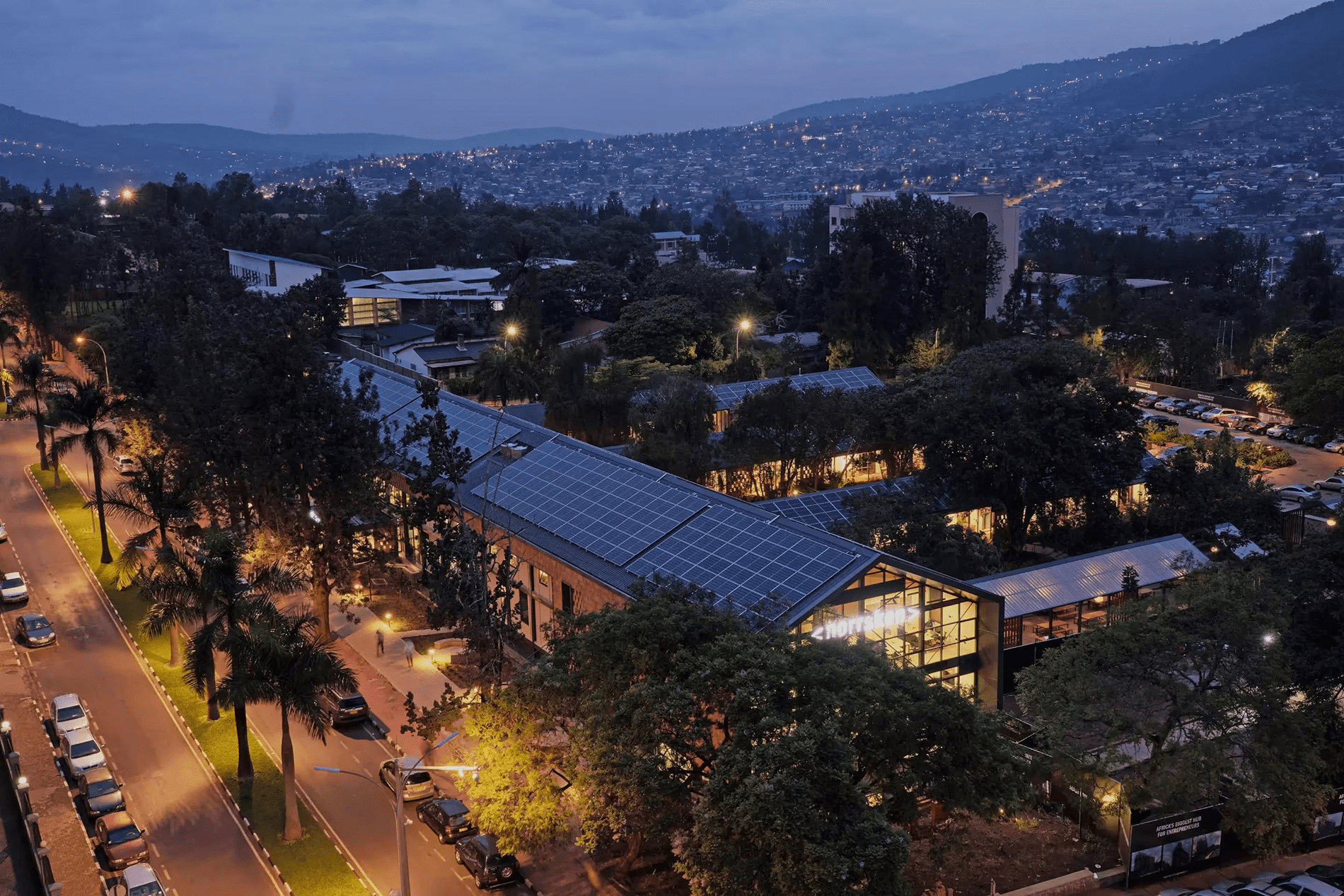

Climate Fund Managers (CFM) is a leading climate-centric blended finance fund manager. We raise and deploy climate finance funds in partnership at scale and at pace. Through its award-winning model, CFM has created a blueprint for a new generation of climate financiers, whose collective impact can help end the climate crisis. CFM currently manages two emerging market infrastructure funds focused on climate change mitigation and adaptation: Climate Investor One, a c. USD 1 billion fund focused on renewable energy, and Climate Investor Two, a c. USD 1 billion fund focused on water, sanitation and oceans infrastructure. CFM is currently implementing further blended finance initiatives in the green hydrogen, power transmission and cities sectors focused on development, equity, debt and guarantee financial instruments.

CFM is currently implementing further blended finance initiatives in the green hydrogen, power transmission and cities sectors focused on development, equity, credit and guarantee financial instruments. In the coming months, CFM will be launching an adaptation and infrastructure focused loan fund(s), private credit blended finance fund(s) that targets deployment of long-term loans, credit facilities, and/or private bonds into climate adaptation, infrastructure and mitigation projects in ~30 emerging market countries with a strong focus on least developing countries and small island developing states.

Established in 2015, CFM is a joint venture between the Dutch Development Bank, FMO, and Sanlam InfraWorks, part of the Sanlam Group of South Africa with offices in The Hague, Cape Town, Singapore and Bogota.

Job Purpose

The Private Credit team is seeking a highly motivated Investment Intern to support the deployment of its fund(s) and the development of broader private credit initiatives. This role offers hands‑on exposure and the opportunity to build strong analytical and technical skills within a private markets environment.

The internship is based in The Hague, Netherlands, and is full‑time, in‑person, and fixed‑term, running from mid‑May to end‑August 2026. Candidates must have the right to work in the EU.

The ideal candidate will have strong financial modelling and analysis skills, with a particular interest in direct lending within private credit. Experience in credit risk assessment and/or impact investing will be an advantage.

This role will be based in The Hague and report to the Senior Manager Private Credit. The preferred candidate will have a credit investor’s mindset and a successful track record of structuring and negotiating private credit and asset-oriented financing solutions.

The intern will be directly involved in all facets of the investment analysis process including industry research, company research, financial modeling, due diligence, legal documentation, and portfolio monitoring/management. They will interact directly with underlying borrower teams, have strong analytical skills, attention to detail, and the ability to work collaboratively within a fast-paced environment. The ideal candidate should be conversant in operating in multi-cultural and diverse team and counterparties.

Key Duties and Responsibilities

Deal Analysis:

- Assist in identifying and sourcing potential private credit investment opportunities.

- Conduct preliminary assessments and screenings of potential deals to determine suitability.

- Analyse financial health, creditworthiness, and risk factors associated with borrowers.

- Conduct due diligence on potential investment opportunities in private credit markets.

Financial Analysis and Due Diligence:

- Assist with analysis of new credit facilities or loans by evaluating the terms, structures, and risks involved.

- Create financial models, assess collateral, and analysing documentation.

- Perform in-depth financial analysis of prospective borrowers, including analysis of financial statements, cash flow projections, and capital structures.

- Conduct comprehensive due diligence, including industry research, competitive analysis, and assessment of management teams.

Investment Structuring and Documentation:

- Assist in structuring loan agreements and negotiating terms with borrowers.

- Prepare and review legal and financial documentation related to credit transactions.

- Assist in concluding and executing transaction up until financial close.

- Track performance, conduct periodic reviews, and identify potential risks or opportunities for optimization.

Portfolio Monitoring:

- Monitor the performance of existing portfolio investments, ensuring compliance with loan terms and covenants.

- Conduct regular reviews and updates of borrower financials and risk assessments.

Market and Industry Analysis:

- Stay informed on market trends, economic conditions, and industry developments that could impact the private credit portfolio.

- Provide insights and recommendations based on market analysis.

Reporting and Communication:

- Investment Recommendation: Assist in the development of Credit Committee papers and supporting analysis; ensure the quality, completeness and accuracy of the analysis that precedes investment recommendations as well as manage the overall delivery of associated materials required for decision making.

- Communicate effectively with internal stakeholders, including senior management, legal, and compliance teams.

Risk Assessment:

- Evaluate credit risk by analysing creditworthiness, identifying potential risks, and assessing the likelihood of borrower default.

- Develop detailed credit memos and risk assessments to support investment recommendations.

Collaboration:

- Work closely with other team members, including senior associates, portfolio managers, and analysts, to support investment decisions, share insights, and contribute to the overall success of the team.

- Provide ongoing support to portfolio teams regarding private credit matters.

- Provide support on capital raising and engagements with prospective investors.

- Collaborate with cross-functional investment teams across regions

Qualifications and Experience

- 2-5 years of proven experience as an Analyst in the Financial services industry within investments or Private Credit.

- 2-5 years of experience in credit analysis, private credit, investment banking, or a related field.

- Strong analytical skills, including proficiency in financial modelling, valuation techniques, and risk assessment.

- Knowledge of credit markets, financial products, and regulatory frameworks related to private credit.

- Excellent communication skills, both written and verbal, for interacting with clients and presenting investment proposals.

- Attention to detail and ability to perform thorough due diligence and analysis.

- Ability to work effectively in a fast-paced, deadline-driven environment and manage multiple tasks simultaneously.

- Proficiency in relevant software and tools, such as Excel, Bloomberg, and financial databases.

- A background in finance, economics, accounting, or a related field is typically required, with relevant work experience in credit analysis or investment management preferred.

- Effective communication and interpersonal skills, with the ability to interact confidently with senior executives, clients, and investors.

Behavioural Competencies

- Devotion to quality

- Performing under pressure

- Results oriented

- Organizational sensitivity

- Commercial drive

- Service oriented

- Analyzing and forming opinions

- Market orientation