Environmental and Social Governance (ESG) Manager Private Credit

Climate Fund Managers

This job is no longer accepting applications

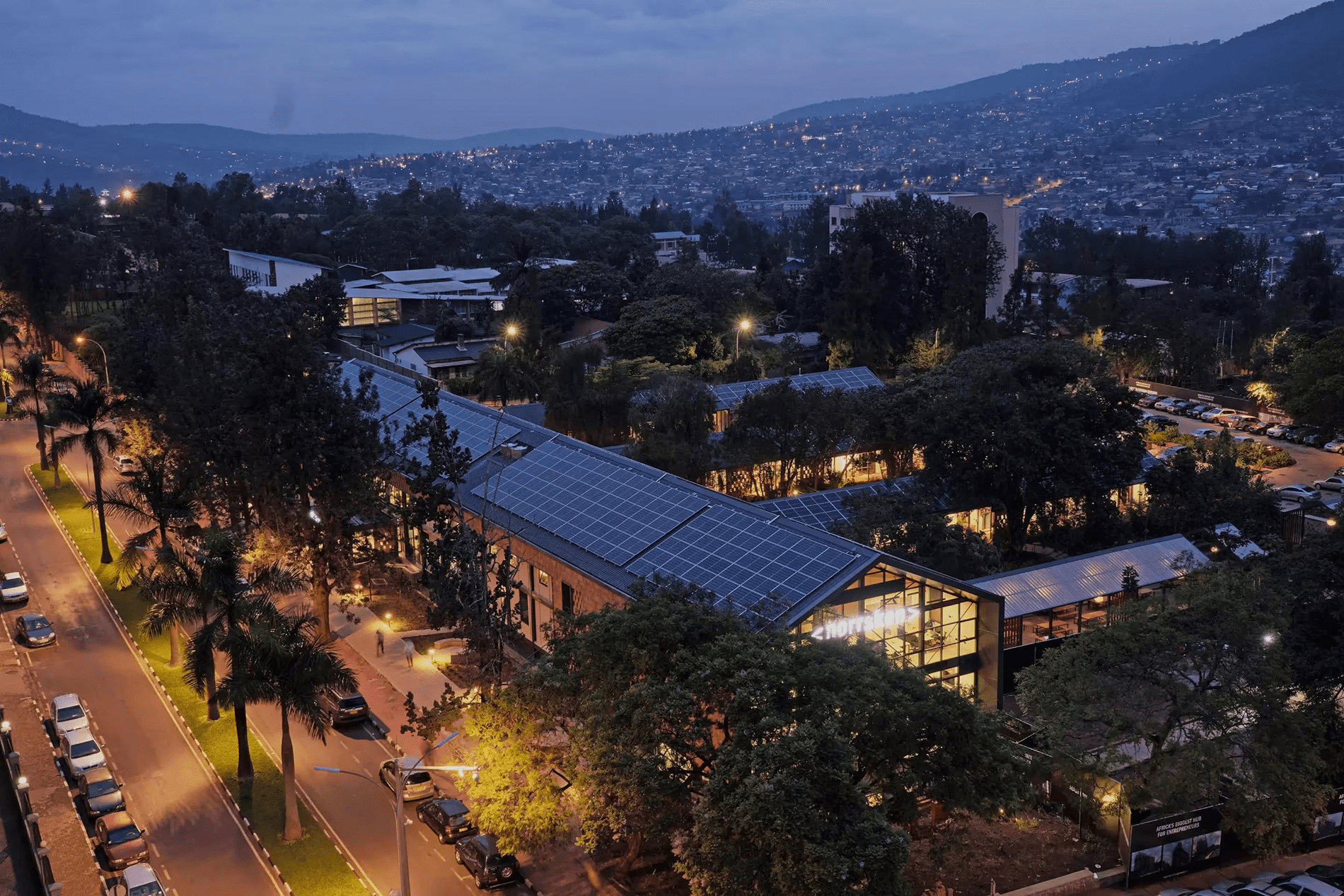

See open jobs at Climate Fund Managers.See open jobs similar to "Environmental and Social Governance (ESG) Manager Private Credit" Norrsken.Introduction

Are you ready for your next play? We are bold, respectful, and we deliver, with Impact. Our long-term vision is to raise, deploy and manage funds for climate change mitigation and adaptation that will play a transformative role in our target sectors.

Climate Fund Managers (CFM) is a leading climate-centric blended finance fund manager. We raise and deploy climate finance funds in partnership at scale and at pace. Through its award-winning model, CFM has created a blueprint for a new generation of climate financiers, whose collective impact can help end the climate crisis. CFM currently manages two emerging market infrastructure funds focused on climate change mitigation and adaptation: Climate Investor One, a c. USD 1 billion fund focused on renewable energy, and Climate Investor Two, a c. USD 1 billion fund focused on water, sanitation and oceans infrastructure.

Established in 2015, CFM is a joint venture between the Dutch Development Bank, FMO, and Sanlam InfraWorks, part of the Sanlam Group of South Africa with offices in The Hague, Cape Town, Windhoek, Singapore and Bogota.

About CFM Private Credit

CFM currently manages three equity funds focused on climate change mitigation and adaptation and recently achieved first close of its first credit fund (the GAIA Climate Loan Fund or ‘GAIA’). GAIA will provide loans to predominantly climate adaptation projects in emerging markets with a focus on Least Developed Countries (LDCs) and Small Island Developing States (SIDS). The fund targets a total size of USD 1.48 billion, with final close anticipated in 2027. GAIA was co-founded by MUFG Bank (Japan's largest financial group); FinDev Canada (Canada’s development finance institution), and the Green Climate Fund (GCF), the world’s largest dedicated climate fund.

GAIA's financing activities focus on climate mitigation, adaptation and resilience across food security, water security, infrastructure, built environment, ecosystems, and ecosystem services and will provide financing to nineteen countries across different geographies concentrated in sub-Saharan Africa, Asia, Latin America and South America.

Job Purpose:

With the launch of GAIA, CFM is seeking an experienced environmental and social governance (ESG) professional to join the CFM Credit Team. This role will play a key value proposition in ensuring the private credit funds align with global sustainability standards and deliver long-term value to investors through responsible investment practices.

The ESG Manager (Private Credit) will lead the integration of ESG principles across the credit investment lifecycle, providing specialist technical expertise at all stages. Initially focused on GAIA, the role will expand as CFM grows the credit business. The ESG Manager (Private Credit) will be full-time and based in CFM’s central office in The Hague, Netherlands with periodic travel to CFM’s regional office locations and project locations. The position will report to the Head of Private Credit and will work closely with the CFM Group Head of Impact & ESG to design and roll out impact and ESG policy and processes tailored to the credit portfolio.

Key Duties and Responsibilities:

- Due Diligence & Risk Assessment: Conduct and manage the ESG due diligence process for all potential investments in accordance with CFM Group policy and processes, resulting in the identification of material ESG risks and opportunities with a focus on climate resilience, carbon intensity, transition risk, and potential for unintended consequences. Manage external ESG consultants appointed to conduct independent due diligence on behalf of the Fund.

- Integration of Impact & ESG in Credit Papers:

Embed impact, climate and ESG factors into credit papers and present material at meetings of both the Climate and Environmental Social and Governance (CESG) Committee and the Credit Committee.

- Portfolio Monitoring & Reporting: Track climate and ESG performance of portfolio companies, prepare regular reports for internal stakeholders and external investors, and ensure compliance with ESG disclosure requirements.

- Stakeholder Engagement: Collaborate with members of the credit team, portfolio companies, technical assistance fund managers, external advisors, governmental and non-governmental organisations, and other external partners.

- Regulatory Compliance: Stay abreast of evolving ESG regulations and ensure all credit fund activities are compliant with relevant laws and frameworks including the Sustainable Finance Disclosure Regulation (SFDR) and EU Taxonomy Regulation.

- Performance Measurement and Monitoring: monitor impact and ESG performance across the credit portfolio including periodic audits of funded activities and validation of data and information reported by portfolio companies.

- Reporting: prepare impact and ESG content for investors and legally mandated reports (e.g. related to SFDR) and contribute to other reporting outputs as required, e.g. to support CFM’s obligations as a member of industry initiatives and affiliations.

- ESG Strategy Development: Support the Head of Impact & ESG in the design and of ESG processes tailored to credit investments, ensuring alignment with fund objectives and global standards.

Required Skills & Experience:

- Master’s degree in a relevant discipline such as environmental sciences, environmental engineering, social sciences, sustainability, or a related field.

- 8-10 years of relevant ESG experience in private credit, asset management, or financial services.

- Excellent knowledge and practical application of the IFC Performance Standards and other international standards for environmental and social impact and risk management.

- Excellent knowledge and experience of working with global frameworks for climate change such as the Paris Agreement and the UNFCCC and climate change policy instruments such as Nationally Determined Contributions (NDCs), National Adaptation Plans, etc.

- Strong understanding of impact and ESG frameworks and reporting standards (e.g. IRIS+, OPIM, GRI, ISSB/IFRS, UN PRI, etc).

- Familiarity with greenfield project development and the required ESG-related activities involved in developing bankable projects (e.g. environmental and social impact assessments and other technical studies prepared in line with international safeguards).

- Experience conducting complex ESG due diligence and integrating ESG into credit investment processes.

- Excellent analytical, communication, and stakeholder management skills.

- Fluent written and oral English language.

- Familiarity with ESG data platforms and tools (e.g., MSCI ESG, Sustainalytics, GRESB).

Preferred

- Experience working with multi-lateral development institutions .

- Experience of working across emerging markets in the public sector

- Experience working in, or with, national or local governments.

- Familiarity with blended finance structures and climate credit instruments and other financial products such as green bonds and social bonds.

- Working knowledge of one or more languages relevant to CFM’s target regions (e.g. French, Spanish)

Skills & Competencies

- Self-driven, proactive, and delivery-focused, with high integrity and discretion.

- Problem Solver and Strategic thinker with strong analytical and problem-solving abilities

- Manage and Influence stakeholders and drive decision-making at all organizational levels

- Systematically organize stakeholders, activities, timeframes and priorities

- Situational Awareness and effective product and market orientation

- Effective communicator and collaborator across technical and non-technical teams

- Ability to manage projects balancing long-term goals with day-to-day execution

- Commitment to fostering a culture of innovation, accountability, and continuous improvement